Shopify tax calculation

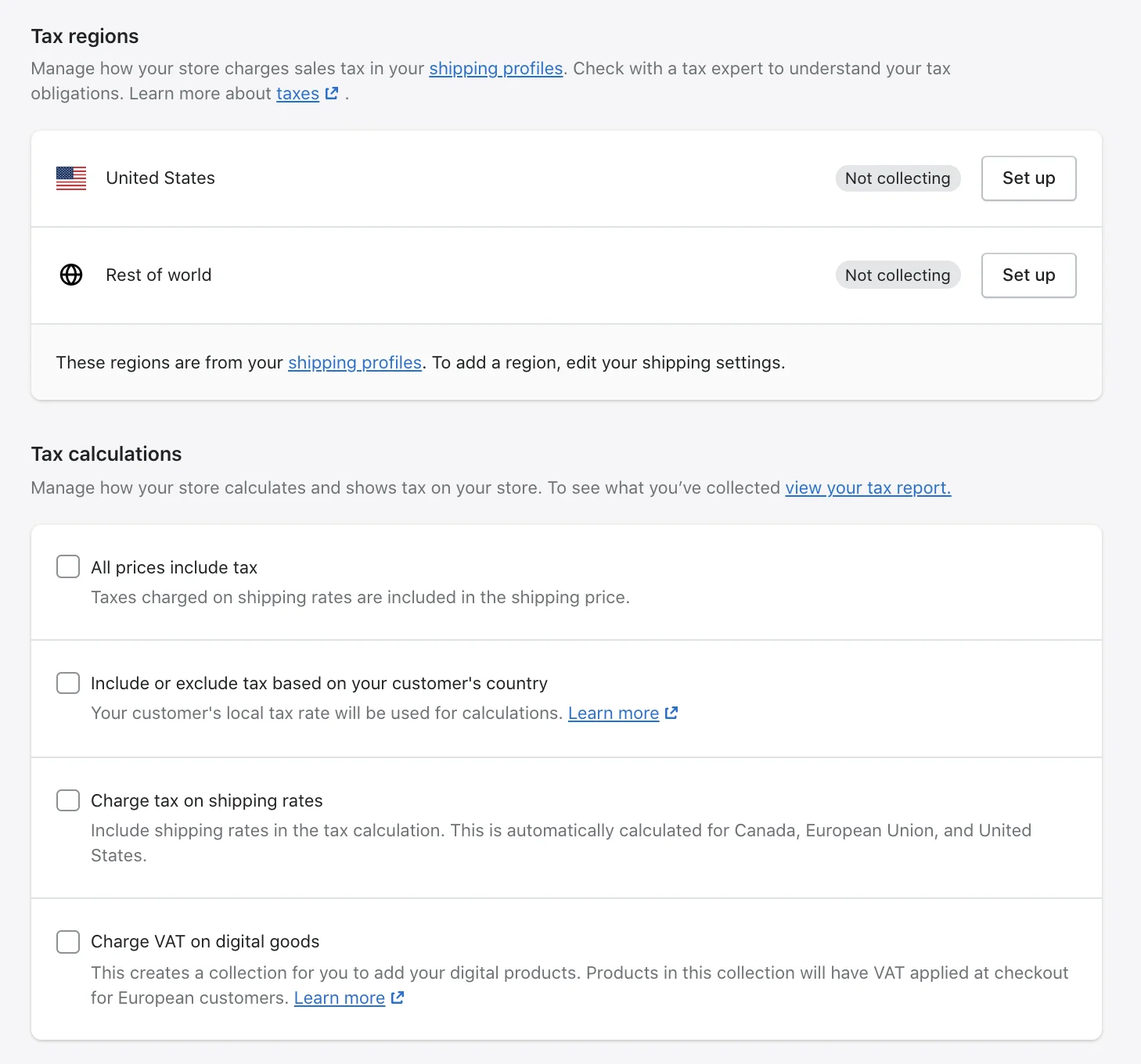

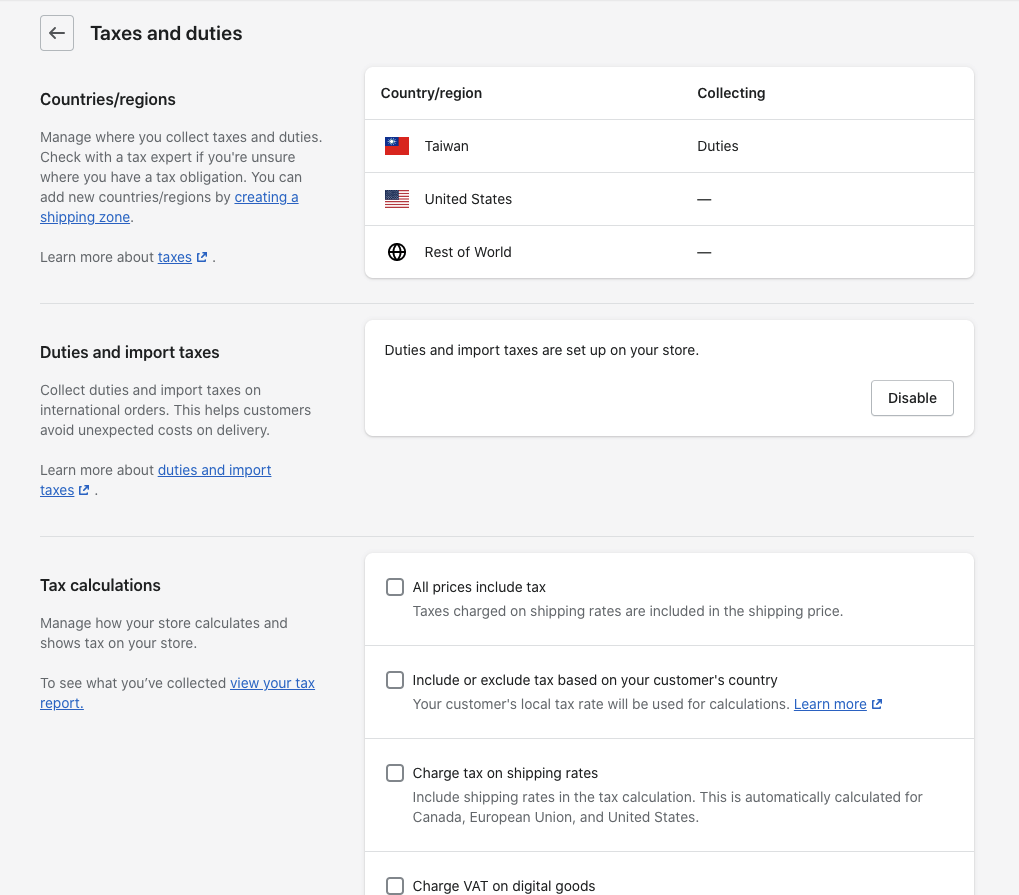

Select Include or exclude tax based on your customers country. App reviews troubleshooting and recommendations.

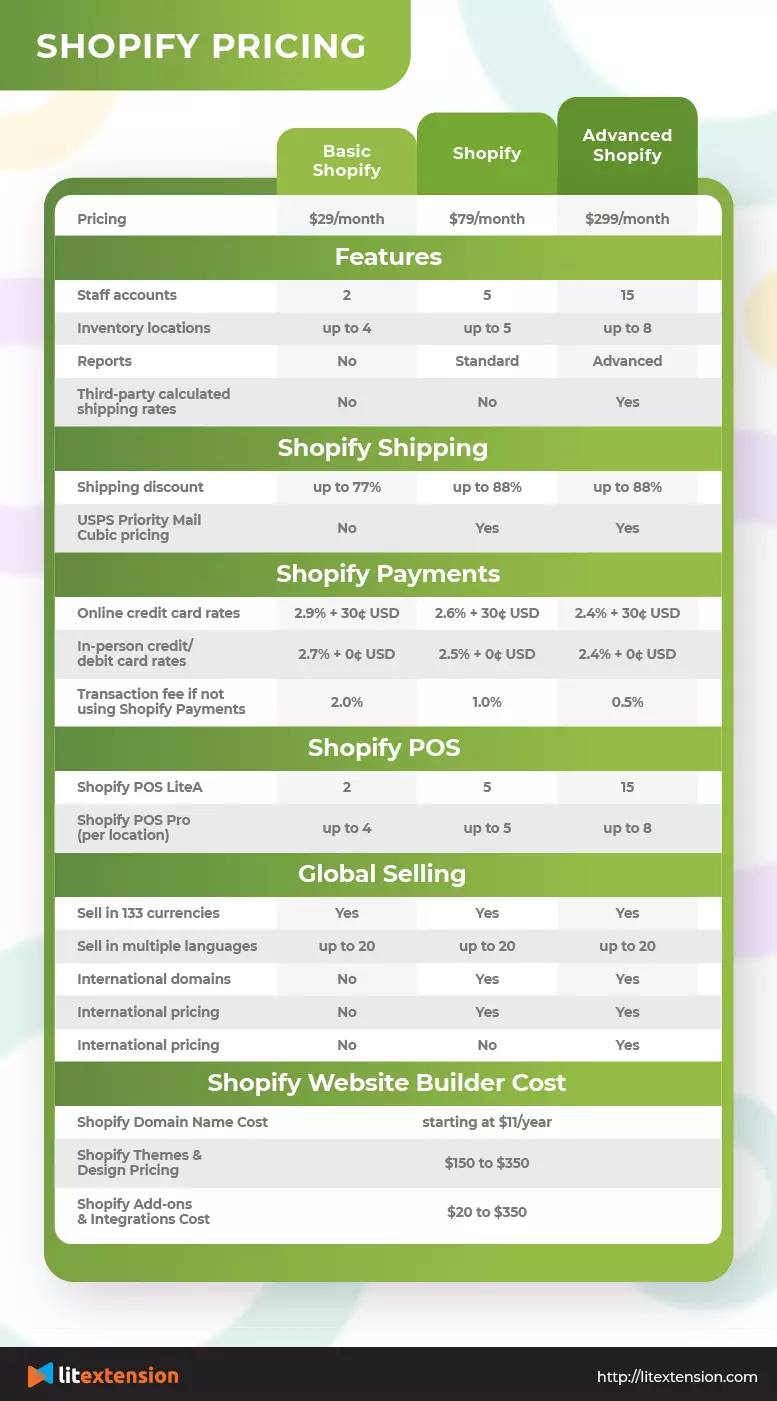

How To Charge Shopify Sales Tax On Your Store Aug 2022

Product reviews app 1.

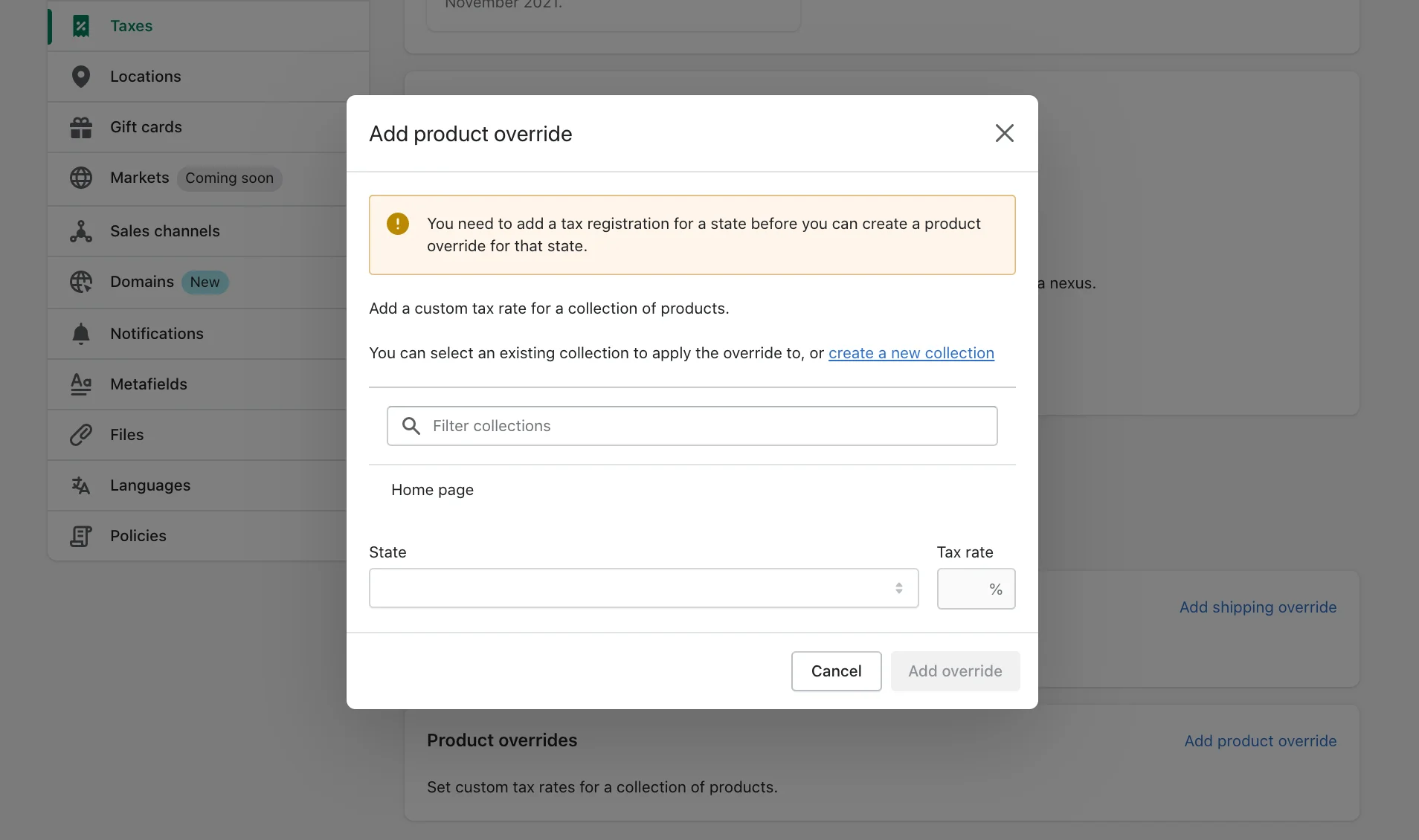

. Its goal is to make it easier for businesses to pay state sales tax by covering the. From your Shopify admin go to Settings Taxes and duties. In a normal workflow we expect to see on average including abandoned.

You can integrate your WooCommerce store with Google Analytics to. How you can use PayPal to. This way you can create the uniqueness that helps you stand out from other competitors and promote your brand.

Businesses that sell services across multiple states need to know where those services are subject to sales tax. Simple Sales Tax for Shopify. From your Shopify admin go to Settings Taxes and duties.

Shopify lets you build websites for your brand where you get to choose your own domain and customize the design of the front-end. The Miami sales tax rate is. Periodically reevaluate your methods.

If you need information about 1099-K forms and you use Shopify Payments then refer to Tax reporting. Special circumstances like tax holidays and product exemptions. Online commerce businesses built on Shopify experienced a 50 growth rate in 2019 compared to the industry.

Shopify Discussions Ask a Question Filter By Board Shopify Scripts Jobs and Careers Technical QA Retail and Point of Sale Shopify Apps Store Feedback Ecommerce Marketing Payments Shipping and Fulfillment Accounting and Taxes Shopify Design Shopify Discussions Announcements Wholesale and Dropshipping Shopify Flow App Site Speed International. Live shipping calculator 1. Get 247 customer support help when you place a homework help service order with us.

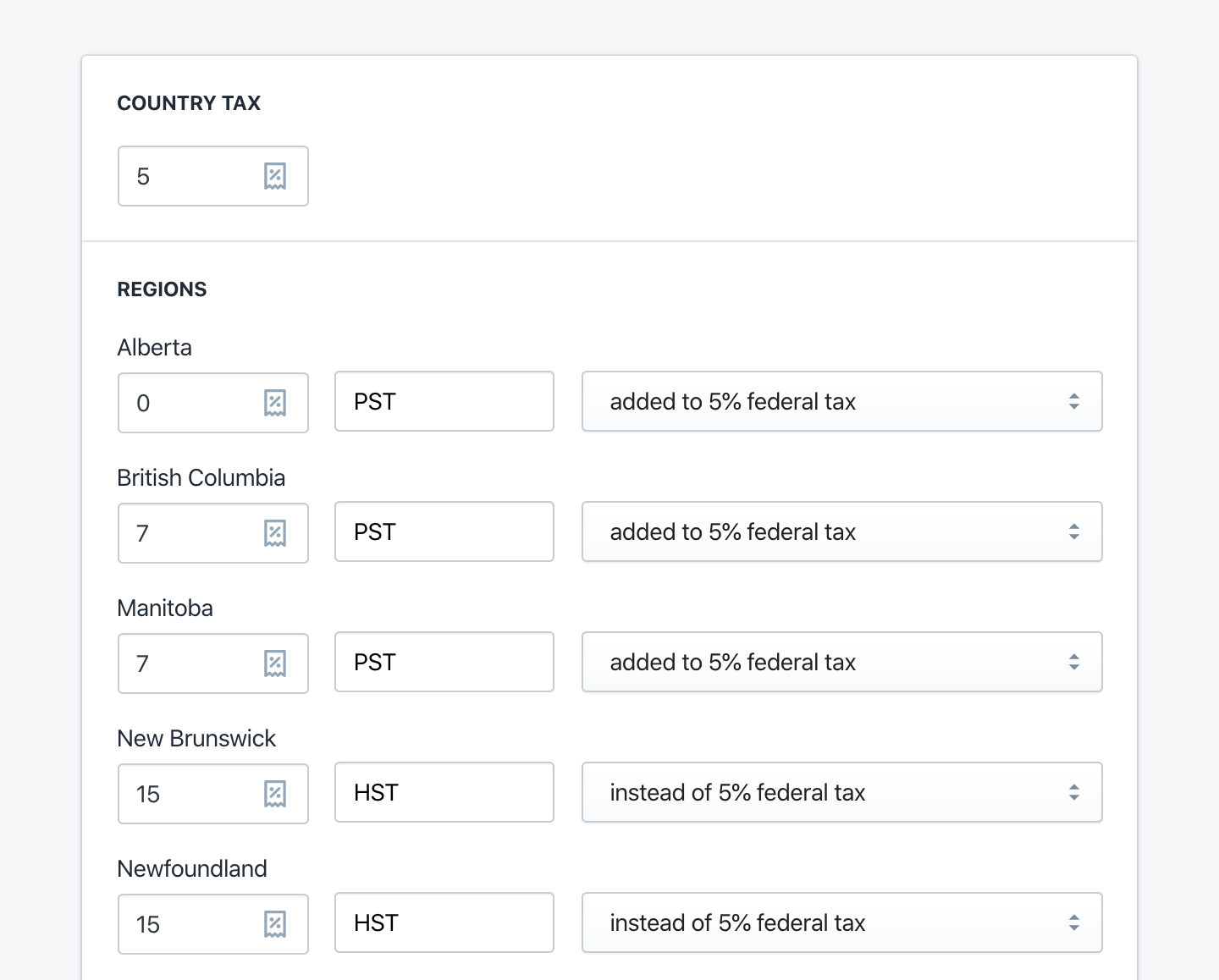

Calculation Type Inputa Inputb. Our cloud-based software delivers the latest sales and use tax calculations to your shopping cart or invoicing system at the point of purchase while accounting for. Instead a calculation is done to determine what percentage of a products price is tax.

Determine your tax liability. The fact that sales tax laws often change makes it challenging to remain in compliance. This is the total of state county and city sales tax rates.

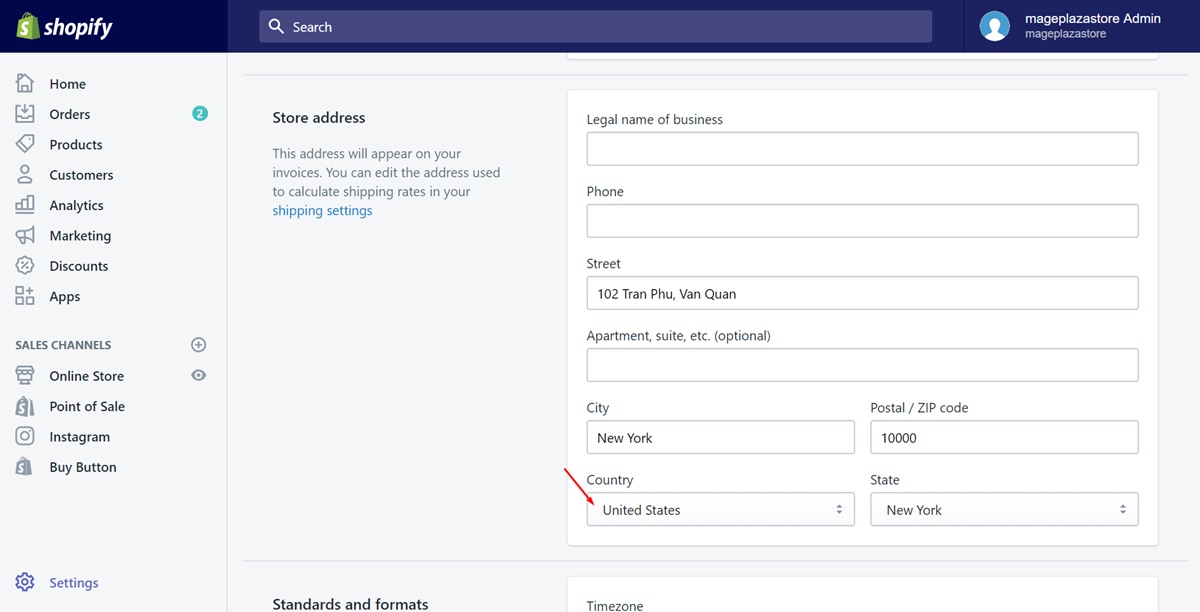

In the Countriesregions section click United States. Please consult your local tax authority for specific details. Shopify will automatically add the default tax rates if you live in a country like the US as they keep updating them over time.

Verifone has a risk management and compliance section that helps you track potential fraud and privacy issues. Button next to the region you want to edit. Reasonable ratio of tax calculation and address validation calls to committed documents.

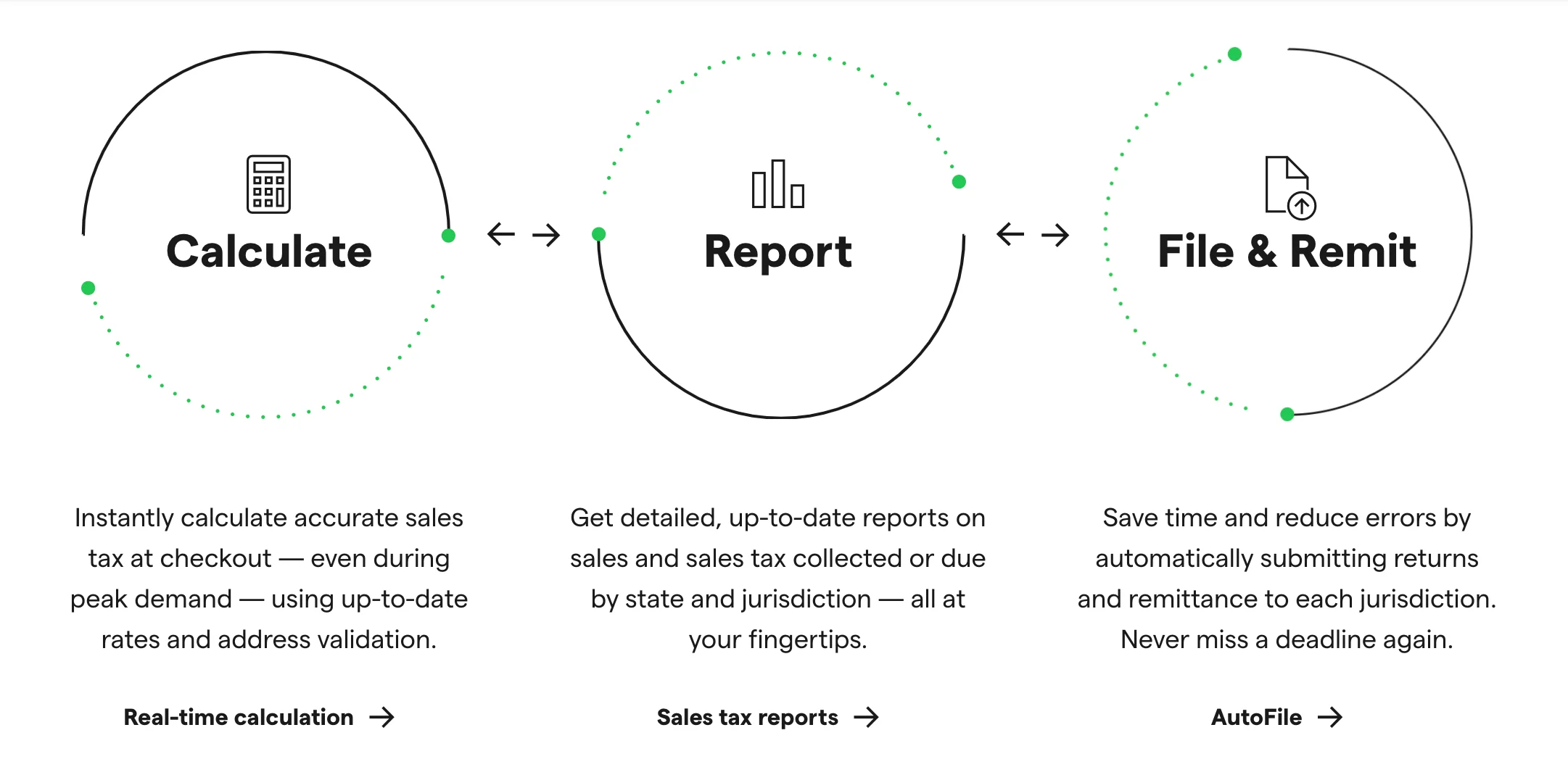

Avalara works with Shopify Plus to. It also has a tax calculation feature that makes it easy for you to manage taxes. Delaware Hawaii New Mexico and South Dakota tax most services.

The Streamlined Sales and Use Tax Agreement was established in 1999 as a cooperative effort between state and local governments and the business community. These professionals help optimize your taxes before you file them helping you learn ways to lower your tax burden. In the Sales tax collection section do either of the following.

It illustrates your optimal salary dividend mix for minimising your overall tax liability and also provides a comparison between Sole Trader and Limited Companies in terms of tax-efficiency at various revenue levels. Scalable cloud-based solutions like Avalara offer up-to-the-minute calculation accuracy geolocation to pinpoint districts and rates and automated filing. The Florida sales tax rate is currently.

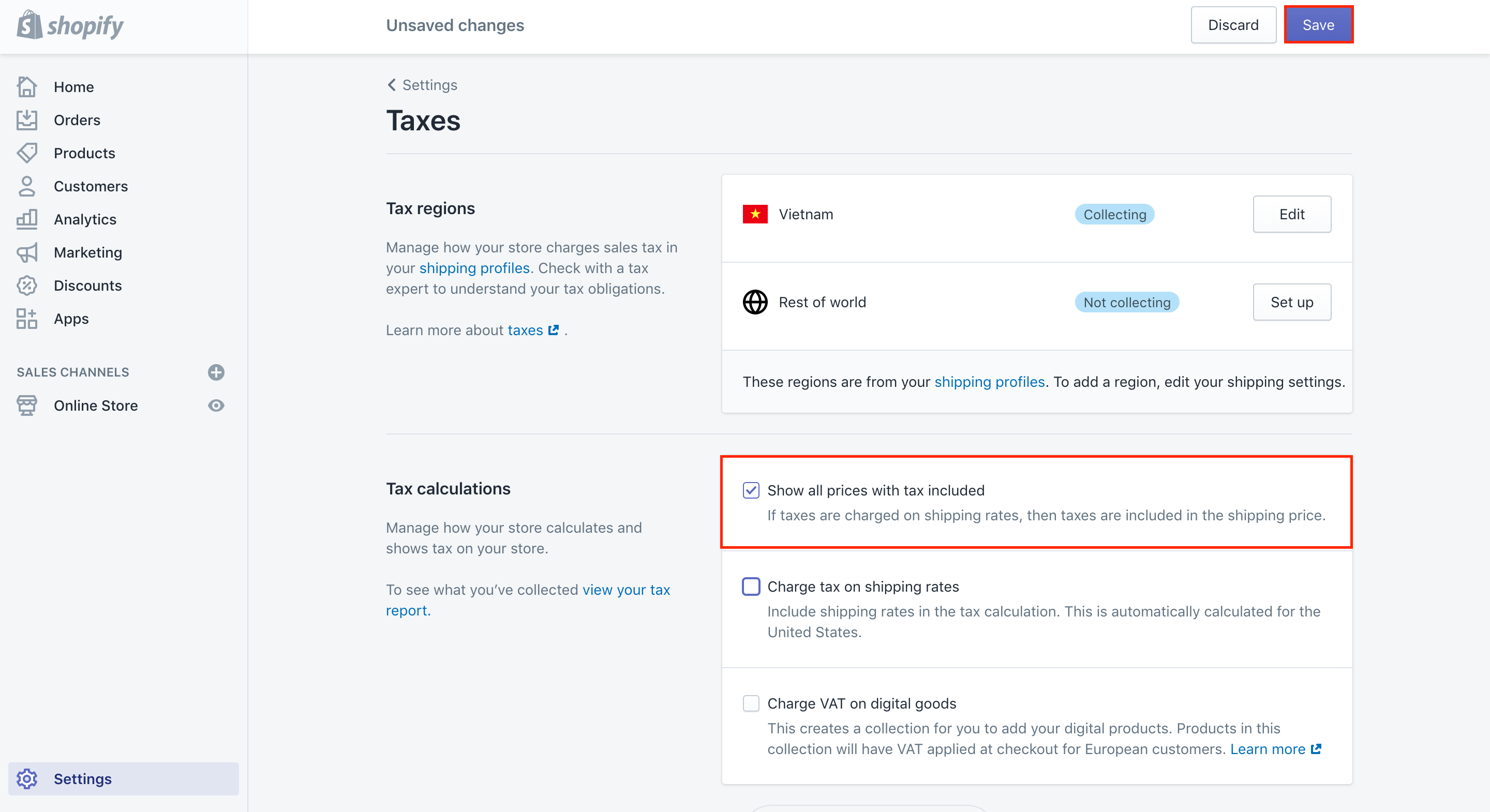

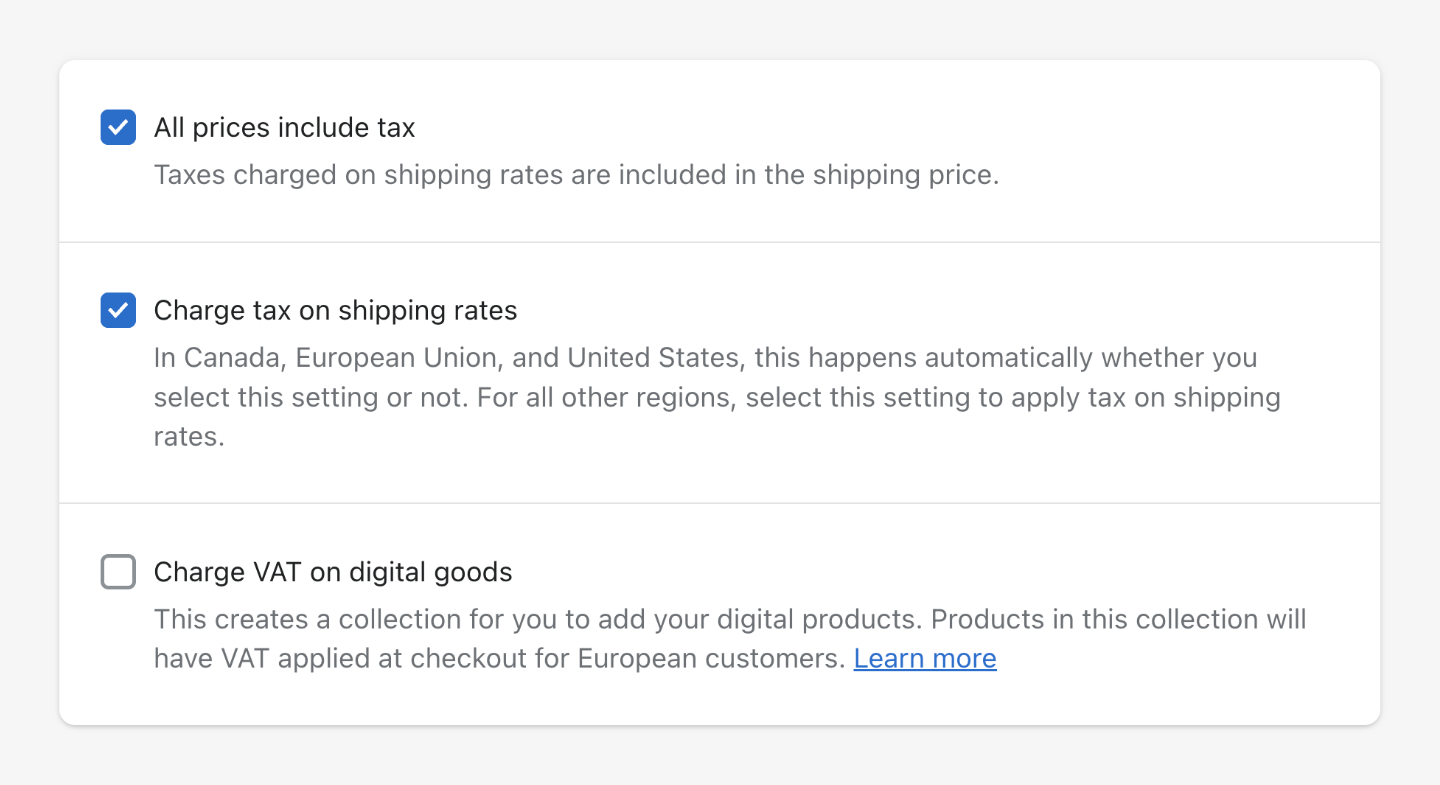

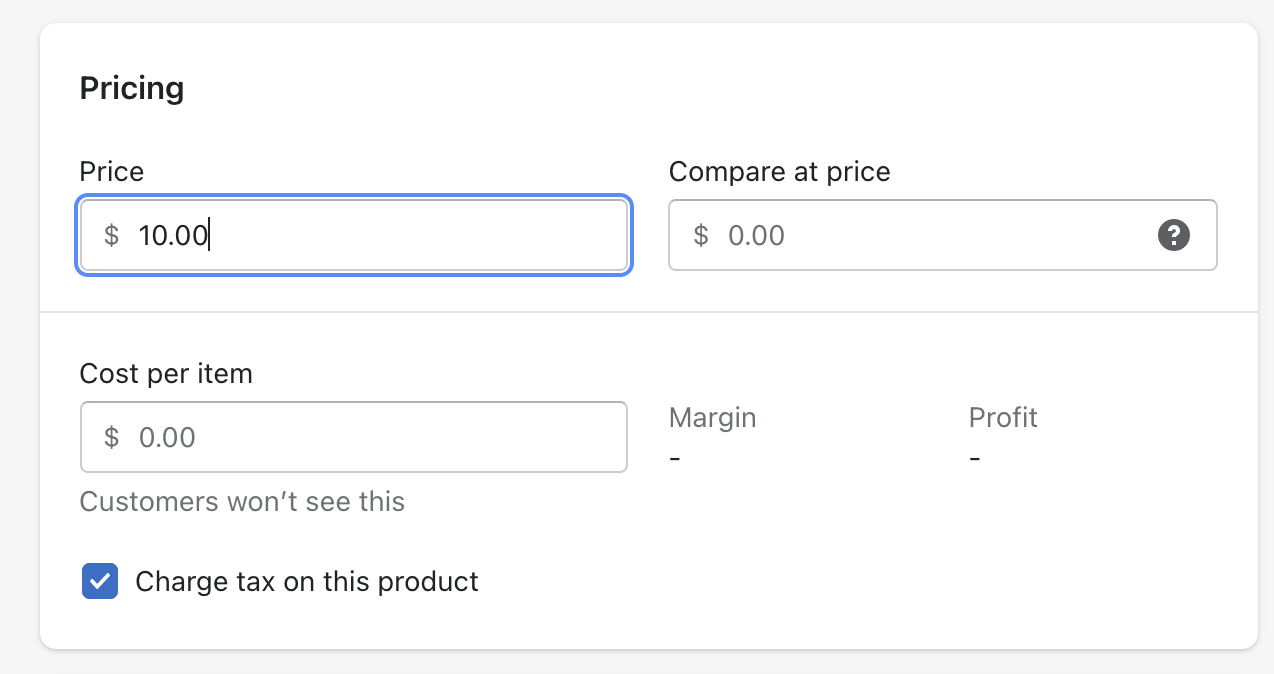

Check All prices include tax. Other noteworthy sales features include easy inventory management shipping options automatic tax calculation and email marketing tools. SHOPIFY RISK SECURITY TEAM.

That said its worth noting that Square Online isnt as powerful. Thankfully Shopify can handle all the sales tax calculations for you and can even set tax overrides for unique situations. However you might want to check and ensure that the current.

Shopify has dropshipping apps that can help you start selling to customers within minutes without the hassle of. To set up a new tax registration click Collect sales tax. The County sales tax rate is.

Mobile Page speed 1. From your Shopify admin go to Settings Markets. Shopify Plus partner Avalara a cloud-based state sales tax compliance solution makes it easy and affordable to automate this labor-intensive burden.

Some will also set up your estimated tax payments. Unlike most other payment methods this Shopify payment option allows you to choose and pay for only the features your business needs. In the Other markets section click Preferences.

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Fulton County. As you set up taxes you can access and review your settings on the Taxes and duties page in your Shopify admin. Take advantage of TaxClouds tax calculation and reports with pricing that scales to fit your needs.

Find the final price of your purchase by calculating the percentage discount on any transaction and the sales tax with the calculator. Employee National Insurance contributions. Multi origin shipping 3.

Still others like Texas and Minnesota are actively expanding service taxability. Employers National Insurance contributions. Before you set up your US taxes you need to determine your tax liability which means whether youre required to collect tax from your customers and remit tax to a state tax authority.

AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements. Shopify is one of the best ecommerce website builders on the market but that doesnt mean that its the best platform for you. Your tax preparer fills out necessary forms and may file them on your behalf during tax season.

Easy insertion of product variants 1. To edit an existing tax registration click the. As a shopper you can use the discount rate formula to.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The minimum combined 2022 sales tax rate for Miami Florida is. Laws rules and jurisdiction boundaries.

Bulk edit Weight Issue 1. Get detailed tax information for your products at time of sale. Conversion rate optimization 2.

How you can use PayPal to accept payments and pay your Shopify bill. The Taxes finance report can provide a summary of the sales taxes that were applied to your sales. To use your customers local tax rate do the following.

Tax rates for each state county and city. All of the inventory management tax calculation and shipping rates management takes place in the WordPress interface. Shopify is a well-known eCommerce platform provider with over one million stores 21 million active users and 155B worth of sold goods on its platform.

Make Sense Of Your Sales Tax Across The Us And Canada 2022

How To Charge Shopify Sales Tax On Your Store Aug 2022

Benefits Of Netsuite Shopify Integration Make Business Integrity Shopify

Set Up Canadian Taxes In Your Shopify Store Sufio For Shopify

How To Charge Shopify Sales Tax On Your Store Aug 2022

Solved Please Help How Do I Enter Taxes Shopify Community

How To Set Up Automatic Tax Rates On Shopify

Make Sense Of Your Sales Tax Across The Us And Canada 2022

How To Charge Taxes On Shopify Store

How To Setup Shipping And Taxes In Shopify Youtube

How To Charge Shopify Sales Tax On Your Store Aug 2022

How To Charge Shopify Sales Tax On Your Store Aug 2022

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

Charge Tax On Shipping Rates In Shopify Sufio For Shopify

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

Shopify Duties And Taxes Support Shopify Markets Easyship Support

Configuring Tax Settings With The Shopify Checkout Integration Recharge